Bitcoin Mining Companies Together Owe $4B In Debt

The past year was evidently rough for Bitcoin investors. Apart from them, even miners took a hit. The lagging price of BTC reduced profitability and made it difficult for miners to cater to their inevitable operational expenses.

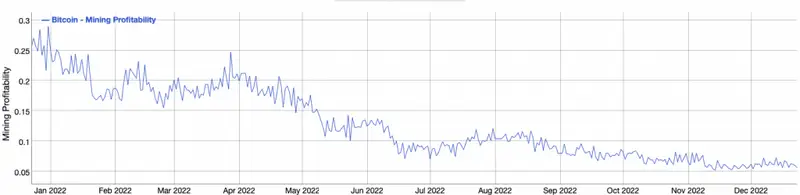

In the beginning of the year, BTC’s mining profitability was fairly high. Like illustrated below, the number kept falling with time. In fact now, it is currently hovering around its lows. At press time, the Bitcoin mining profitability stood at $0.0504 per day for 1 THash/s.

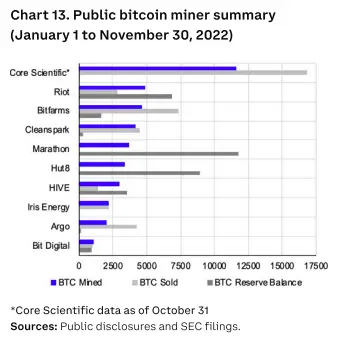

Selling has been rampant this year by miners. A recent report from Coinbase highlighted,

“… some of the largest public Bitcoin miners sold more Bitcoin than they mined during 2022, depleting their reserves in the process. Other operators – such as Marathon Digital and Hut8 – didn’t sell any bitcoin during 2022, aided by the relative health of their balance sheets. In aggregate, the 10 public bitcoin miners detailed here mined ~40.7k BTC and sold ~40.3k BTC year-to-date in 2022, with ~34.2k BTC held in their reserves as of November 30.“

Also Read – Bitcoin: Is A Christmas Miracle Rally Likely?

Debt Mounts Up For Public Bitcoin Mining Companies

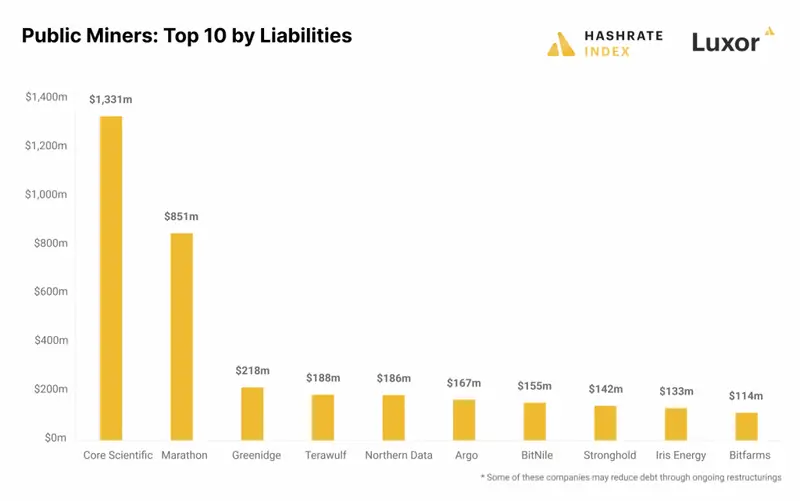

Bitcoin mining data compiled by Hashrate Index revealed that the public Bitcoin mining companies collectively owe more than $4 billion in debt. Core Scientific owes the most among them.

As of the end of Q3, it had $1.3 billion in liabilities on its balance sheet. The report also outlined that the company’s cash flows have evaporated in tandem with the falling Bitcoin price and rising electricity prices. Owing to the stress faced, Core Scientific declared bankruptcy in the beginning of this week.

Read More: Bitcoin Mining Firm Core Scientific To File For Chapter 11 Bankruptcy

With $851 million in liabilities, Marathon is the second largest debtor. Chalking out why the said company doesn’t face an immediate threat of going insolvent, Hashrate Index’s report noted,

“Most of this debt is convertible notes, which come with no monthly debt service payments but instead give the holders the option to convert them to stock. Therefore, Marathon’s debt is relatively easy to service, and the company is not at immediate risk of going bankrupt.”

Parallelly, Greenidge is the third-biggest debtor. The company owes $218 million, but is undergoing a restructuring process that could reduce its debt by a fair share.

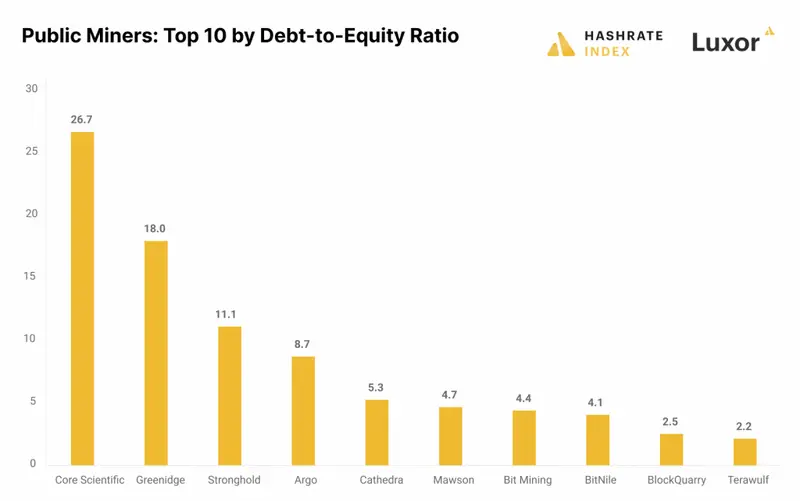

Furthermore, on a whole, the debt-to-equity ratio of public bitcoin mining companies is “dangerously high” at the moment. Conventionally, a debt-to-equity ratio of 2 or higher is considered risky in most industries. Chalking out the current trend, Hashrate Index noted,

“There are around 25 public bitcoin miners. Almost half of them have debt-to-equity ratios higher than 2. The entire bitcoin mining sector has total liabilities of $4 billion and equity of $2.2 billion, giving it a debt-to-equity ratio of 1.8, which is relatively high compared to most other industries.“

Also Read: Bitcoin Exchange Supply Drops To 4Y Lows: What Does It Mean?

Comments

Post a Comment